All Categories

Featured

Table of Contents

They generally offer an amount of insurance coverage for a lot less than irreversible types of life insurance policy. Like any kind of plan, term life insurance policy has benefits and drawbacks relying on what will function best for you. The benefits of term life include cost and the capacity to tailor your term size and coverage quantity based upon your needs.

Relying on the kind of plan, term life can use fixed premiums for the whole term or life insurance on degree terms. The fatality benefits can be repaired. Due to the fact that it's a cost effective life insurance policy product and the payments can remain the same, term life insurance policy plans are preferred with youngsters simply starting out, households and people that desire security for a particular time period.

Effective Decreasing Term Life Insurance Is Often Used To

You should consult your tax obligation consultants for your specific factual scenario. Rates mirror policies in the Preferred Plus Price Class concerns by American General 5 Stars My representative was really knowledgeable and helpful while doing so. No pressure to get and the procedure fasted. July 13, 2023 5 Stars I was satisfied that all my demands were satisfied promptly and professionally by all the agents I talked to.

All documents was digitally completed with accessibility to downloading for individual documents upkeep. June 19, 2023 The endorsements/testimonials presented need to not be understood as a suggestion to buy, or a sign of the value of any type of item or service. The reviews are real Corebridge Direct consumers who are not affiliated with Corebridge Direct and were not given settlement.

1 Life Insurance Coverage Statistics, Information And Industry Trends 2024. 2 Price of insurance policy prices are determined making use of methods that differ by company. These prices can vary and will typically enhance with age. Prices for energetic workers might be various than those offered to terminated or retired staff members. It is necessary to take a look at all aspects when reviewing the general competitiveness of rates and the value of life insurance policy protection.

Coverage-Focused The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

Like many group insurance coverage plans, insurance policy policies supplied by MetLife contain certain exclusions, exemptions, waiting durations, reductions, limitations and terms for maintaining them in force (which of these is not an advantage of term life insurance). Please call your benefits manager or MetLife for costs and full details.

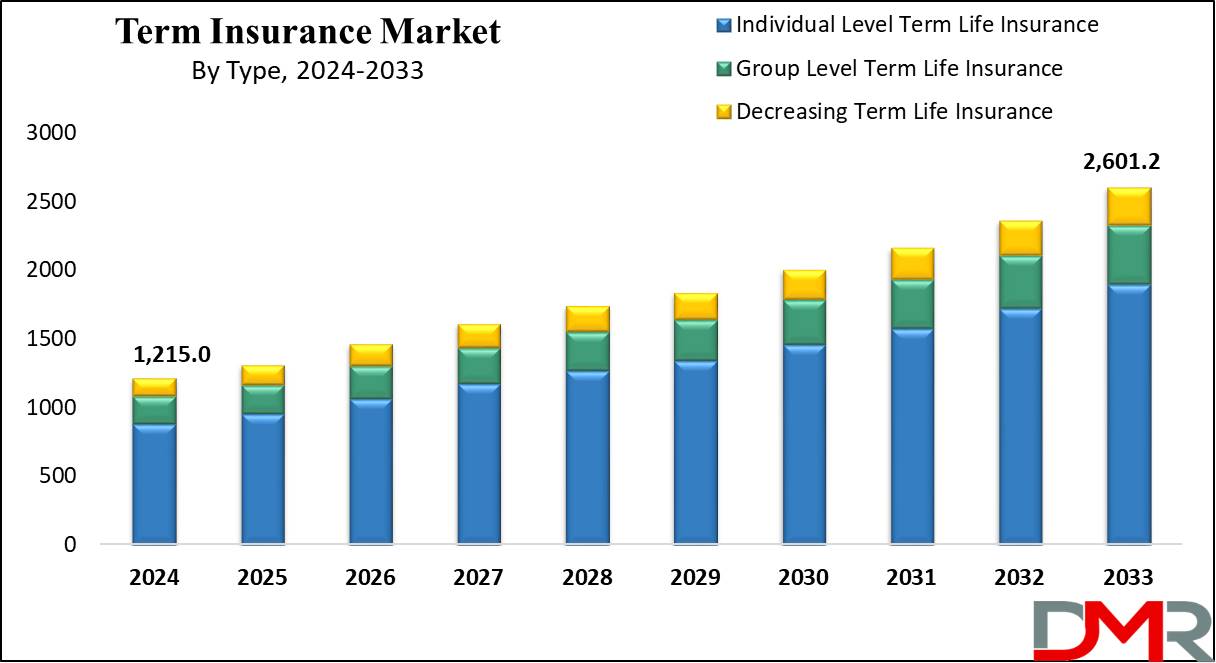

For the many component, there are two kinds of life insurance policy prepares - either term or permanent plans or some mix of both. Life insurance companies use various kinds of term plans and typical life plans as well as "passion sensitive" products which have actually come to be extra common since the 1980's.

Term insurance provides defense for a given duration of time. This duration can be as brief as one year or give coverage for a details number of years such as 5, 10, 20 years or to a specified age such as 80 or in some cases as much as the oldest age in the life insurance policy death tables.

Tailored Level Term Life Insurance Definition

Currently term insurance coverage prices are really affordable and amongst the lowest traditionally seasoned. It needs to be kept in mind that it is a commonly held idea that term insurance is the least pricey pure life insurance policy coverage readily available. One requires to evaluate the plan terms very carefully to decide which term life options are ideal to meet your certain scenarios.

With each brand-new term the premium is increased. The right to renew the plan without evidence of insurability is a crucial advantage to you. Otherwise, the danger you take is that your wellness might deteriorate and you may be unable to obtain a plan at the same rates and even in any way, leaving you and your beneficiaries without coverage.

You must exercise this alternative throughout the conversion period. The size of the conversion duration will certainly vary depending upon the type of term policy purchased. If you convert within the recommended duration, you are not needed to provide any kind of details regarding your health and wellness. The premium price you pay on conversion is usually based on your "existing achieved age", which is your age on the conversion day.

Under a level term policy the face amount of the plan remains the same for the whole duration. Usually such plans are marketed as home mortgage protection with the quantity of insurance reducing as the balance of the mortgage decreases.

Typically, insurers have actually not can transform premiums after the plan is sold (what is decreasing term life insurance). Because such policies might continue for several years, insurance firms should use conservative death, rate of interest and cost rate price quotes in the premium estimation. Adjustable costs insurance, however, allows insurance firms to use insurance policy at lower "current" costs based upon much less conservative assumptions with the right to change these costs in the future

Budget-Friendly Annual Renewable Term Life Insurance

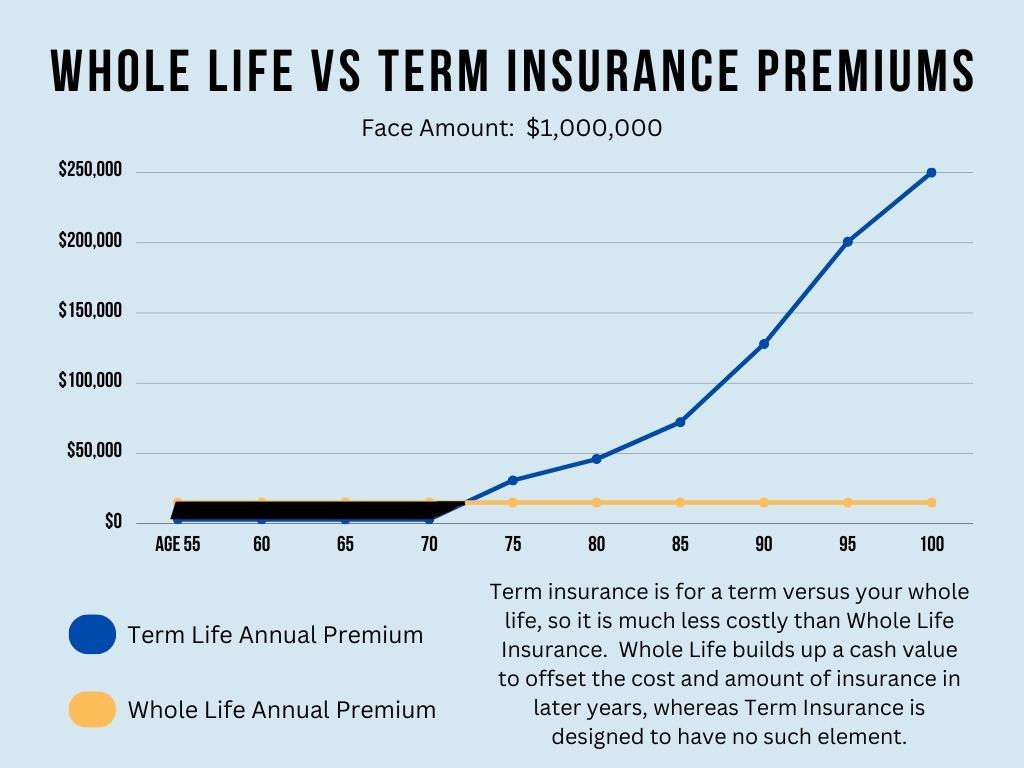

While term insurance coverage is created to offer defense for a defined period, permanent insurance is made to offer insurance coverage for your entire life time. To maintain the costs price level, the costs at the more youthful ages exceeds the actual price of protection. This extra costs constructs a get (cash money value) which aids spend for the plan in later years as the cost of security surges over the costs.

The insurance policy company spends the excess costs dollars This type of policy, which is occasionally called money value life insurance coverage, creates a savings component. Money worths are crucial to a permanent life insurance coverage plan.

Comprehensive What Is Level Term Life Insurance

Occasionally, there is no relationship between the size of the cash value and the costs paid. It is the cash value of the plan that can be accessed while the insurance policy holder lives. The Commissioners 1980 Standard Ordinary Mortality (CSO) is the present table utilized in computing minimum nonforfeiture worths and policy reserves for regular life insurance policy policies.

Lots of long-term plans will certainly contain stipulations, which specify these tax requirements. There are 2 standard classifications of permanent insurance, standard and interest-sensitive, each with a number of variants. In addition, each classification is usually offered in either fixed-dollar or variable form. Conventional entire life plans are based upon long-term quotes of expense, rate of interest and mortality.

If these estimates transform in later years, the company will adjust the premium appropriately but never ever above the optimum guaranteed costs stated in the policy. An economatic whole life policy attends to a basic amount of getting involved entire life insurance policy with an additional supplemental protection provided with the use of returns.

Since the premiums are paid over a much shorter span of time, the premium payments will certainly be higher than under the whole life plan. Solitary costs entire life is limited settlement life where one big exceptional repayment is made. The policy is fully paid up and no additional premiums are called for.

Latest Posts

Affordable Burial Insurance

Purchase Burial Insurance

Cheap Burial Insurance Policies