All Categories

Featured

Table of Contents

A level term life insurance policy plan can give you peace of mind that individuals who depend on you will have a survivor benefit during the years that you are planning to support them. It's a method to help look after them in the future, today. A level term life insurance policy (often called level premium term life insurance coverage) policy offers insurance coverage for an established variety of years (e.g., 10 or 20 years) while keeping the costs payments the same for the period of the policy.

With level term insurance coverage, the price of the insurance coverage will certainly remain the very same (or potentially reduce if dividends are paid) over the regard to your plan, usually 10 or two decades. Unlike permanent life insurance policy, which never ends as lengthy as you pay costs, a degree term life insurance policy plan will certainly end at some factor in the future, commonly at the end of the duration of your degree term.

What Is What Does Level Term Life Insurance Mean? The Complete Overview?

As a result of this, numerous individuals utilize long-term insurance coverage as a stable financial preparation device that can serve lots of demands. You may have the ability to convert some, or all, of your term insurance coverage during a collection duration, generally the very first ten years of your plan, without needing to re-qualify for insurance coverage also if your health and wellness has actually altered.

As it does, you may desire to include to your insurance coverage in the future - Level premium term life insurance policies. As this happens, you might want to ultimately reduce your death benefit or take into consideration transforming your term insurance to a permanent plan.

As long as you pay your costs, you can relax simple recognizing that your enjoyed ones will obtain a survivor benefit if you die during the term. Several term plans enable you the ability to convert to permanent insurance without having to take an additional health examination. This can permit you to make use of the fringe benefits of an irreversible policy.

Degree term life insurance policy is among the most convenient courses into life insurance policy, we'll review the advantages and disadvantages to make sure that you can pick a plan to fit your needs. Degree term life insurance policy is one of the most common and basic form of term life. When you're looking for short-term life insurance plans, level term life insurance policy is one route that you can go.

The application process for level term life insurance policy is generally really straightforward. You'll submit an application that consists of general personal information such as your name, age, and so on along with a much more thorough questionnaire regarding your clinical background. Depending on the policy you're interested in, you may have to take part in a medical exam procedure.

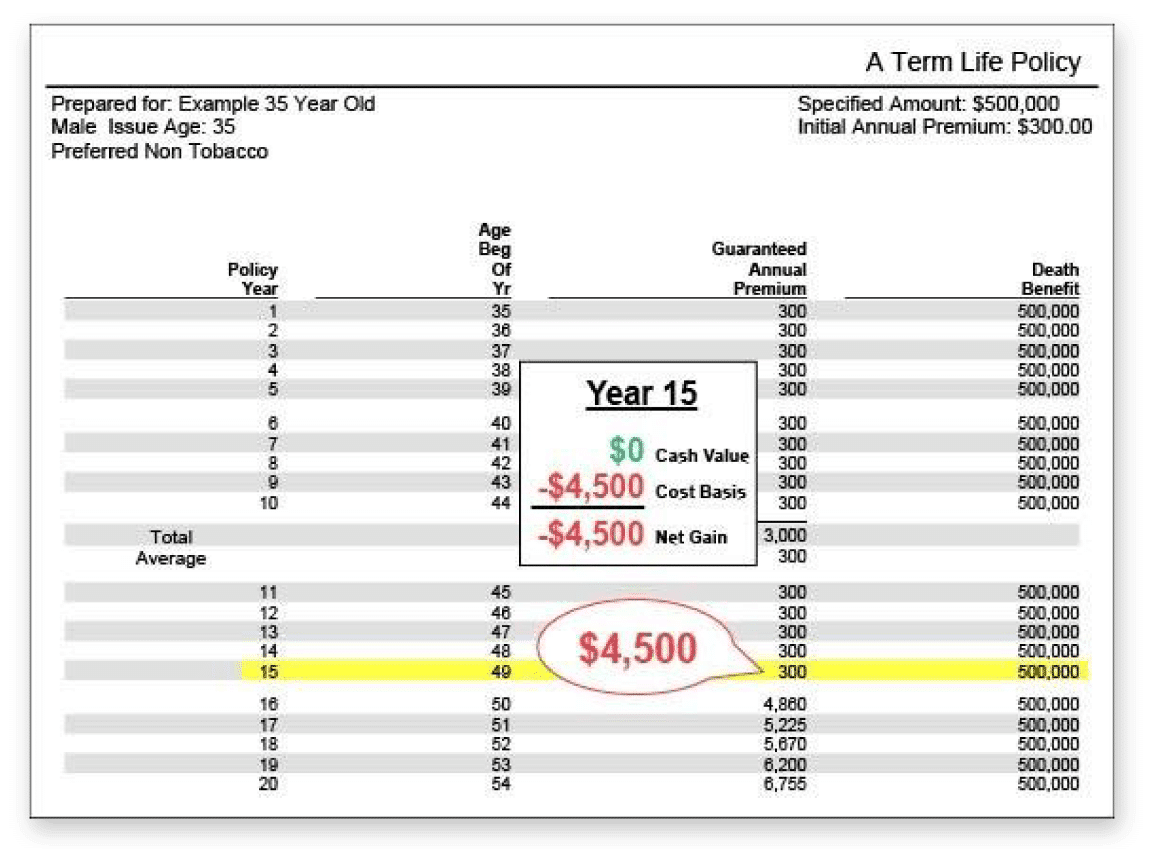

The brief answer is no. A degree term life insurance coverage policy doesn't construct money value. If you're wanting to have a policy that you have the ability to take out or borrow from, you may explore long-term life insurance policy. Entire life insurance policy plans, as an example, allow you have the convenience of survivor benefit and can accumulate cash money worth over time, meaning you'll have much more control over your benefits while you're active.

What Exactly is Level Benefit Term Life Insurance?

Motorcyclists are optional provisions contributed to your policy that can provide you added advantages and defenses. Cyclists are a great way to include safeguards to your policy. Anything can occur throughout your life insurance policy term, and you wish to await anything. By paying just a little bit more a month, cyclists can offer the assistance you need in instance of an emergency.

There are circumstances where these benefits are developed right into your policy, yet they can additionally be available as a separate enhancement that needs extra repayment.

Latest Posts

Affordable Burial Insurance

Purchase Burial Insurance

Cheap Burial Insurance Policies