All Categories

Featured

Table of Contents

They normally offer an amount of insurance coverage for a lot less than long-term kinds of life insurance policy. Like any policy, term life insurance policy has advantages and disadvantages depending on what will certainly work best for you. The benefits of term life include price and the capability to customize your term size and coverage amount based on your needs.

Depending on the type of plan, term life can supply set costs for the whole term or life insurance policy on degree terms. The fatality benefits can be dealt with.

Value Which Of These Is Not An Advantage Of Term Life Insurance

Rates mirror policies in the Preferred And also Rate Course concerns by American General 5 Stars My agent was extremely knowledgeable and practical in the process. July 13, 2023 5 Stars I was satisfied that all my needs were met promptly and skillfully by all the representatives I spoke to.

All documents was electronically completed with access to downloading for individual data maintenance. June 19, 2023 The endorsements/testimonials provided should not be interpreted as a referral to acquire, or a sign of the value of any product and services. The testimonies are actual Corebridge Direct consumers who are not affiliated with Corebridge Direct and were not provided settlement.

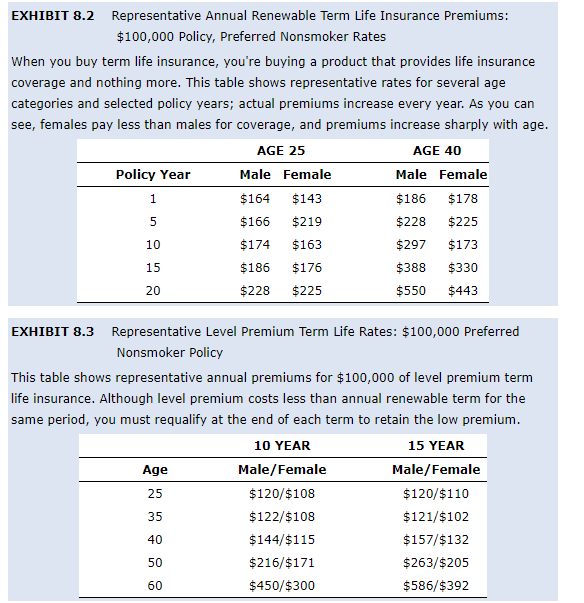

1 Life Insurance Coverage Stats, Information And Market Trends 2024. 2 Cost of insurance policy prices are figured out making use of methods that differ by company. These rates can differ and will typically increase with age. Rates for energetic workers may be various than those offered to ended or retired workers. It is very important to consider all elements when examining the total competitiveness of rates and the value of life insurance policy protection.

Innovative Term 100 Life Insurance

Like many team insurance policy policies, insurance plans supplied by MetLife have specific exclusions, exceptions, waiting periods, decreases, limitations and terms for keeping them in pressure (decreasing term life insurance). Please call your benefits manager or MetLife for costs and total information.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

For the many part, there are 2 sorts of life insurance policy plans - either term or permanent plans or some combination of both. Life insurers supply different forms of term strategies and typical life plans as well as "passion delicate" items which have actually become a lot more prevalent considering that the 1980's.

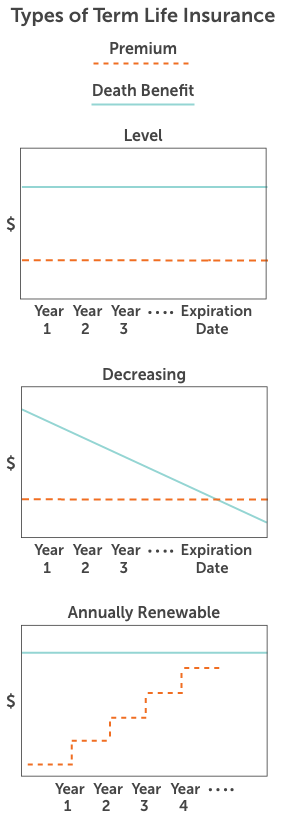

Term insurance policy offers defense for a specific duration of time. This period might be as brief as one year or give protection for a particular number of years such as 5, 10, two decades or to a specified age such as 80 or in some instances as much as the oldest age in the life insurance policy mortality.

Budget-Friendly Short Term Life Insurance

Presently term insurance policy prices are extremely competitive and amongst the cheapest traditionally seasoned. It should be kept in mind that it is a commonly held idea that term insurance policy is the least costly pure life insurance policy protection offered. One requires to examine the plan terms carefully to choose which term life alternatives appropriate to meet your specific circumstances.

With each brand-new term the premium is boosted. The right to renew the policy without evidence of insurability is an essential advantage to you. Otherwise, the danger you take is that your health and wellness might deteriorate and you might be incapable to get a plan at the very same prices or even whatsoever, leaving you and your beneficiaries without protection.

The size of the conversion period will differ depending on the kind of term plan acquired. The costs price you pay on conversion is generally based on your "existing acquired age", which is your age on the conversion date.

Under a degree term policy the face amount of the plan continues to be the very same for the entire duration. Typically such policies are sold as home loan defense with the quantity of insurance coverage reducing as the equilibrium of the mortgage decreases.

Typically, insurance providers have not deserved to transform costs after the plan is offered (does term life insurance cover accidental death). Given that such policies might continue for numerous years, insurance providers should use conventional death, rate of interest and expenditure price price quotes in the premium estimation. Adjustable costs insurance, nonetheless, permits insurance firms to offer insurance coverage at lower "present" premiums based upon much less conventional presumptions with the right to transform these premiums in the future

Sought-After Direct Term Life Insurance Meaning

While term insurance policy is developed to give defense for a specified time period, permanent insurance is designed to give insurance coverage for your entire lifetime. To maintain the costs rate degree, the premium at the more youthful ages surpasses the real expense of defense. This extra premium constructs a book (money worth) which aids pay for the policy in later years as the price of defense rises above the costs.

Under some plans, costs are needed to be paid for a set variety of years. Under various other policies, costs are paid throughout the insurance policy holder's life time. The insurer spends the excess costs dollars This kind of plan, which is sometimes called money worth life insurance policy, generates a savings component. Cash worths are critical to an irreversible life insurance policy policy.

Coverage-Focused What Is Decreasing Term Life Insurance

Often, there is no connection in between the dimension of the money worth and the costs paid. It is the cash value of the policy that can be accessed while the insurance holder lives. The Commissioners 1980 Standard Ordinary Death Table (CSO) is the existing table made use of in determining minimum nonforfeiture values and policy books for ordinary life insurance coverage plans.

Lots of permanent plans will certainly include arrangements, which define these tax obligation requirements. There are 2 standard groups of irreversible insurance, conventional and interest-sensitive, each with a variety of variants. On top of that, each classification is usually offered in either fixed-dollar or variable kind. Traditional whole life policies are based upon lasting price quotes of expense, passion and death.

If these quotes change in later years, the business will adjust the costs accordingly yet never above the maximum assured costs specified in the plan. An economatic whole life plan offers a basic quantity of taking part entire life insurance coverage with an additional supplementary insurance coverage provided through the use of returns.

Since the premiums are paid over a shorter period of time, the costs settlements will be greater than under the whole life strategy. Single costs whole life is minimal settlement life where one large superior payment is made. The policy is totally paid up and no additional premiums are needed.

Latest Posts

Affordable Burial Insurance

Purchase Burial Insurance

Cheap Burial Insurance Policies